In a new market study on the small task-oriented vehicle (STOV) market in the US and Canada, Small Vehicle Resource (SVR), LLC predicts growth over the 2017-2021 period. The market research reveals four trends coming together that will result in market gains of mid to high single digits in the forecast period and an industry value in the range of $15.8 billion at retail including parts and accessories.

- Growing appreciation in a highly diverse market for the effectiveness of STOVs specifically designed to meet individual segment needs;

- Increasing competition that will drive new product development as manufacturers seek to strengthen current market strongholds and stake out additional market segments with new and/or expanded product lines;

- Continuing focus on accessories and attachments to enhance the versatility and value of STOVs, boost revenues and supplant other vehicle types such as pick-ups and tractors for work and full-size vehicles for transportation;

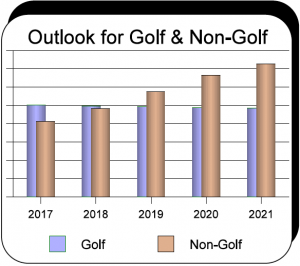

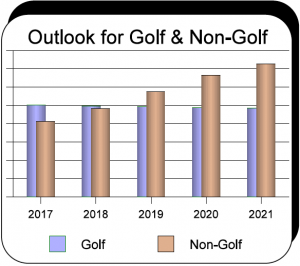

- Golf manufacturers emphasizing non-fleet markets over the continuing slow/negative growth golf car fleet market.

Steve Metzger, SVR Managing Director, states that, “While the fleet market remains in a downsizing mode, it is a marginal decline. It will remain a significant component of the golf car-type vehicle market. On the other hand, SVR forecasts continued sizable gains in the non-fleet market, including light utility and transporter vehicles and personal transportation vehicles.” Metzger also notes, “SVR anticipates that important new opportunities lie ahead, including self-driving technology applications, as well as potential for a much broader market on a global basis.”

Marc Cesare, SVR Managing Director adds, “The off-road utility vehicle market continues to be a competitive vortex for golf car manufacturers seeking new markets, the powersports industry, and traditional manufacturers of work related utility vehicles. While market growth will be slower than the recent high growth years, it remains solid,” Cesare notes, “ and competition will drive product innovation in both base vehicles as well as options and attachments that improve vehicle performance and versatility.”

Approximately a third of the market value is from electric powered STOVs, primarily in the form of golf cars or golf car derived utility vehicles and personal transportation vehicles (PTVs). PTVs are golf cars modified for gated community or low speed public road use and include low speed vehicles (LSVs). Key trends and projections for the market include:

- In total, demand for electric powered STOVs will increase to over 300,000 vehicles in 2021.

- The demand for non-fleet golf car type vehicles will more than offset the slight decline in the fleet golf car market, moving from under 50% of the total demand to over 50%.

- Light utility vehicles produced by golf car and other manufacturers are expected to grow approximately 10% annually to 2021.

- PTVs will continue to grow low single digits during the trend period and electric powered PTVs will slowly increase to represent nearly 75% of the market by 2021. LSVs will account for about one-fifth of the PTVmarket.

Metzger, states that, “The potential for even greater electric powered STOV growth is there. In the PTV market the combination of market forces and emerging technologies could greatly increase the applicability of PTVs. Increasing urbanization is expected to create congestion and pollution issues, and the search for new transportation solutions. The advent of self-driving vehicle technology along with improved battery technology creates the potential for mobility platforms that can in part be based on small PTVs.” He further notes, “Gated communities with their more controlled environments could prove to be excellent testing grounds and the concepts could then migrate to urban environments that are well suited to low speed vehicle operations.”

The new study, the eighth in the series of studies produced by SVR since 2000, covers utility, off-road, and personal transportation vehicles, and fleet golf cars.

The study is entitled, 2017 Market Report on the Small, Task-Oriented Vehicle Industry: Transition and Growth –Trends from 2012; Forecasts to 2021.

For additional, detailed information on study content a brochure is available with a table of contents ( Small Task-Oriented Vehicle Study – Analysis & Forecast (PDF)) or contact:

Steve Metzger, smetzger@smallvehicleresource.com

(914) 293-7577